VAT "CAROUSEL" FRAUD: INTERNATIONAL IN SCOPE (1/3)

VAT "carousel" fraud originates in Europe (1/3)

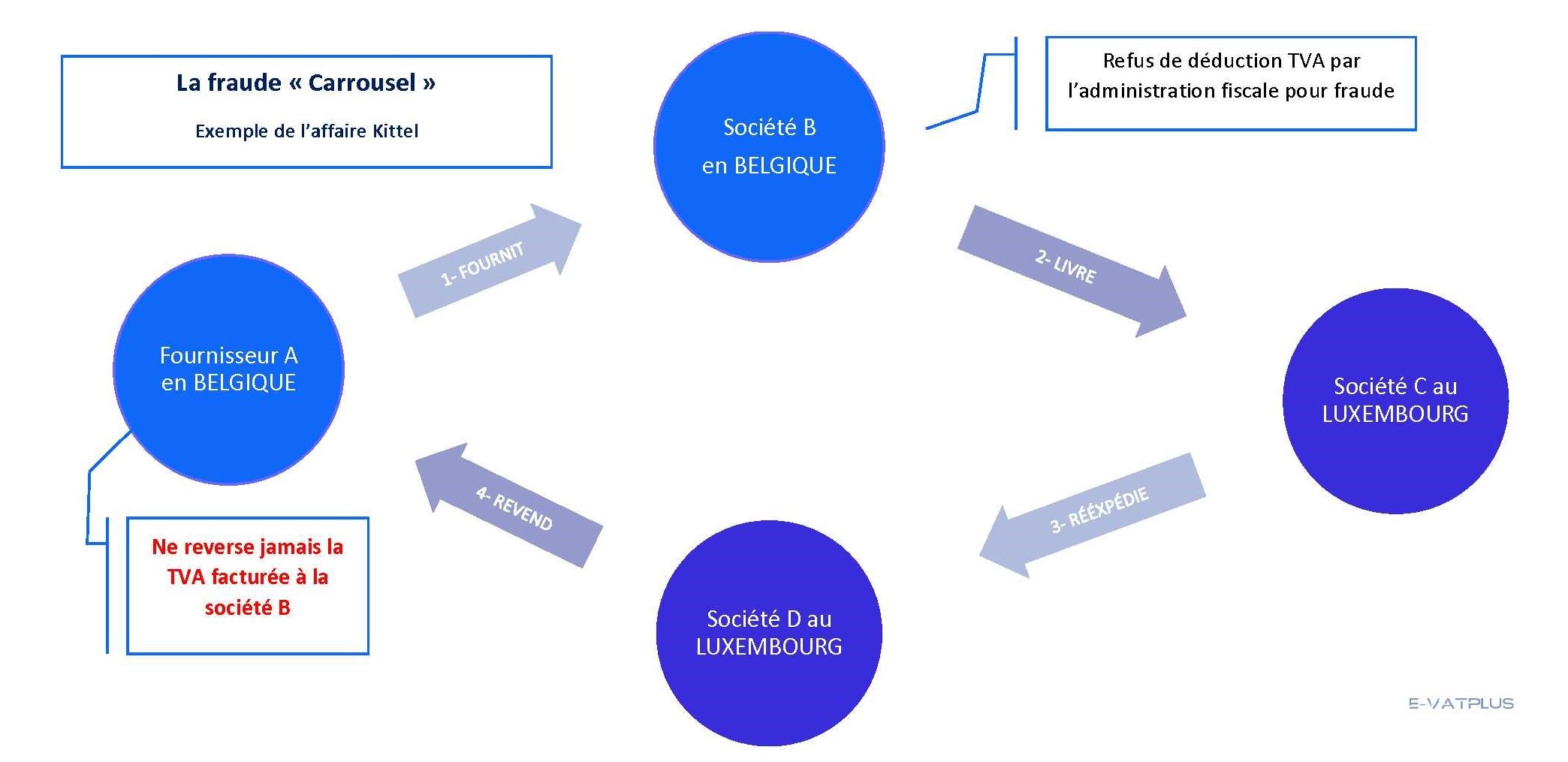

Carousel fraud developed in the Benelux region in the 1970s. It is now widely established throughout the European Union.

Those involved in fraud create a multitude of companies that sell at a loss, systematically claiming VAT deductions. The operation is carried out so quickly that national tax authorities have no time to identify the perpetrators and punish them.

When the tax authorities suspect "carousel" fraud, they must characterize the constituent elements of the fraud with precision:

- Proving fraudulent acts;

- Demonstrate the responsibility of those involved in this fraud;

The CJEU accepts that the tax authorities will not refund VAT in cases of fraud if it can be shown that the trader could have known that he was involved in fraud.

Fraud cannot be presumed.

In 2021, the French Supreme Court[1] ruled that VAT fraud was an offence in its own right, and that it could lead to a double conviction for tax fraud and VAT fraud when the element characterizing tax fraud does not constitute an element of the fraudulent maneuvers involved in the fraud.

This "carousel" fraud is difficult for national tax authorities to apprehend, due to the speed of the operation and its cross-Community dimension.

This is where the creation of the EPPO (European Public Prosecutor's Office) comes in, to centralize the investigations of national tax authorities more efficiently. The result was almost immediate, as the Prosecutor's Office uncovered one of the biggest intra-Community frauds in 2022.

[1] Cass. crim., Jan. 6, 2021, n° 19-85.133 : JurisData n° 2021-000111 ; Dr. pén. 2021, comm. 66, P. Conte

e-VATplus is here to help you.